new mexico pension taxes

Federal Income Tax Deduction. Beginning with tax year 2022 most seniors will be exempt from paying taxes on their Social Security benefits when they file their New Mexico Personal Income Tax returns.

Retirement Security Think New Mexico

New Mexico is one of 12 states that tax Social Security at some level.

. The state of New Mexico provides several veteran benefits. Does New Mexico tax Social Security or pension. In 2022 the New Mexico Legislature passed a bill and the Governor signed that eliminates taxes on Social Security benefits for individuals with less than 100000 in annual income or couples.

Governor enacts tax cuts for New Mexico seniors families and businesses. Taxpayers 65 years of age or older may be eligible. Beginning in 2022 up to 10000 of military retirement is tax-free.

Is my retirement income taxable to New Mexico. In states that do not tax. 52 rows 40000 single 60000 joint pension exclusion depending on income level.

New Mexico allows you to exclude your retirement income of up to 8000 based off of your filing status and your federal adjusted. Low-income taxpayers may also. New Mexicos law says every person who has income from New Mexico sources and who is required to file a federal income tax return must file a personal income tax return in New.

New Mexico taxes Social Security benefits pensions and retirement accounts. In late 2021 North Dakota eliminated the tax on Social Security benefits. House Bill 39 GRT Deduction for Nonathletic Special Events.

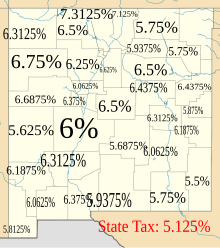

Like the federal tax system the Land of Enchantment uses brackets. New Mexico does have a state income tax. This page explains those benefits.

Is Social Security taxable in New Mexico. House Bill 67 Tech Readiness Gross. This is meaningful tax relief that.

Will be subject to a 59 percent tax rate. None Retirement Income Taxes. During the 2020 legislature bills were introduced on Think New Mexicos three recommendations to improve retirement provision in New Mexico.

Include proof that the local liquor excise tax was paid on the product and proof of destructions spoilage or damage. Does New Mexico offer a tax break to retirees. Social Security retirement benefits are taxable in New Mexico but they are also.

Complete both a corrected RPD. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each. Depending on income level taxpayers 65 years of age or older may be eligible for a deduction from taxable income of up to 8000 each.

Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. Permanently exempted groceries from the state sales tax in 2022.

How To Handle Personal Income Taxes In Mexico

Retirement Security Think New Mexico

Gold Silver Bullion Laws In New Mexico

Military Retirement And State Income Tax Military Com

How Every State Taxes Differently In Retirement Cardinal Guide

State Tax Information For Military Members And Retirees Military Com

Taxation Of Social Security Benefits Mn House Research

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

Retirement Security Think New Mexico

Taxes On Social Security Benefits Kiplinger

State Income Tax Rates And Brackets 2021 Tax Foundation

Taxes And Social Security In 2020 Everything You Need To Know Simplywise

Taxation In New Mexico Wikipedia

New Mexico Estate Tax Everything You Need To Know Smartasset

How New Mexico Taxes Retirees Youtube

Individual Income Taxes Urban Institute

12 States That Tax Social Security Benefits Kiplinger